Building or expanding a church is a significant undertaking that often requires substantial financial resources. For many congregations, securing a loan is a crucial step in turning their vision into reality. This comprehensive guide will walk you through the process of obtaining a loan for a church building, providing valuable insights and practical advice to help you navigate this complex journey.

2. Understanding Church Building Loans

Church-building loans are specialized financial products designed to meet the unique needs of religious organizations. These loans can be used for various purposes, including:

- Constructing a new church building

- Purchasing an existing property

- Renovating or expanding current facilities

- Refinancing existing church debt

Unlike traditional business loans, church-building loans take into account the specific characteristics of religious organizations, such as their non-profit status, reliance on donations, and community-oriented mission.

3. Types of Church Building Loans

Several types of loans are available for church-building projects:

3.1 Construction Loans

These short-term loans cover the costs of building a new church or making significant renovations. They typically have higher interest rates and require interest-only payments during the construction phase.

3.2 Permanent Mortgages

Once construction is complete, churches can refinance their construction loan into a long-term mortgage with more favorable terms and lower interest rates.

3.3 Bridge Loans

These short-term loans help churches cover immediate expenses while waiting for long-term financing or the sale of an existing property.

3.4 Lines of Credit

Revolving credit lines provide flexibility for ongoing expenses or smaller renovation projects.

3.5 Bond Programs

Some larger churches may opt for bond financing, which involves issuing debt securities to investors.

4. Preparing Your Church for a Loan Application

Before applying for a loan, take these steps to strengthen your church’s financial position:

4.1 Establish a Strong Financial Track Record

Maintain accurate and up-to-date financial records, including income statements, balance sheets, and cash flow projections.

4.2 Build a Healthy Debt Service Coverage Ratio

Aim for a ratio of at least 1.25, indicating that your church’s income can comfortably cover loan payments.

4.3 Develop a Robust Fundraising Strategy

Implement effective fundraising campaigns to demonstrate your congregation’s commitment and financial stability.

4.4 Create a Detailed Business Plan

Outline your church’s mission, growth projections, and plans for loan repayment.

4.5 Form a Building Committee

Assemble a team of qualified individuals to oversee the building project and loan application process.

5. Steps to Apply for a Church Building Loan

Follow these steps to navigate the loan application process:

5.1 Research Potential Lenders

Look for lenders specializing in church loans, including banks, credit unions, and religious financial institutions.

5.2 Gather Required Documentation

Collect financial statements, tax returns, membership data, and other relevant information.

5.3 Submit Loan Applications

Apply to multiple lenders to compare offers and terms.

5.4 Review and Negotiate Loan Terms

Carefully evaluate interest rates, repayment schedules, and any covenants or restrictions.

5.5 Secure Congregational Approval

Many churches require a vote or formal approval process before accepting a loan offer.

5.6 Close the Loan

Work with your lender and legal counsel to finalize the loan agreement and close the deal.

6. Factors Lenders Consider

Understanding what lenders look for can help you strengthen your loan application:

6.1 Financial Health

Lenders will scrutinize your church’s income, expenses, and overall financial stability.

6.2 Membership Growth

A growing congregation indicates the potential for increased donations and financial support.

6.3 Leadership Stability

Long-term, experienced leadership can instill confidence in lenders.

6.4 Property Value

The value of your current or proposed property serves as collateral for the loan.

6.5 Debt-to-Income Ratio

Lenders prefer churches with manageable debt levels relative to their income.

6.6 Community Impact

Your church’s role in the community can demonstrate its importance and stability.

7. Alternative Financing Options

In addition to traditional loans, consider these alternative financing methods:

7.1 Crowdfunding

Utilize online platforms to raise funds from supporters beyond your immediate congregation.

7.2 Capital Campaigns

Launch targeted fundraising efforts specifically for your building project.

7.3 Grants

Research and apply for grants from religious organizations or community foundations.

7.4 Partnerships

Explore partnerships with other churches or community organizations to share resources and costs.

7.5 Lease-to-Own Agreements

Consider leasing a property with an option to purchase in the future.

8. Tips for Success

Implement these strategies to improve your chances of securing a favorable loan:

8.1 Start Early

Begin the loan application process well in advance of your planned construction or purchase date.

8.2 Be Transparent

Provide clear, honest information about your church’s finances and plans.

8.3 Demonstrate Community Support

Show evidence of strong community backing for your building project.

8.4 Seek Professional Advice

Consult with financial advisors, lawyers, and other experts throughout the process.

8.5 Have a Backup Plan

Develop contingency plans in case loan terms are less favorable than expected.

8.6 Communicate with Your Congregation

Keep your members informed and involved in the loan process.

9. Challenges and How to Overcome Them

Be prepared to address common obstacles in the church building loan process:

9.1 Limited Credit History

If your church has a limited credit history, focus on building relationships with local lenders and demonstrating financial responsibility.

9.2 Fluctuating Income

Address concerns about variable donation income by showcasing consistent core support and diverse funding sources.

9.3 Zoning Issues

Work closely with local authorities to navigate zoning regulations and obtain necessary permits.

9.4 Construction Delays

Build flexibility into your loan terms to account for potential delays in the construction process.

9.5 Economic Uncertainty

Develop stress-tested financial projections to show your ability to repay the loan under various economic scenarios.

10. Case Studies

Examining real-world examples can provide valuable insights:

10.1 Small Rural Church Expansion

Learn how a small congregation successfully secured financing to expand their facilities through a combination of local bank loans and community fundraising.

10.2 Urban Megachurch Construction

Explore how a large urban church navigated complex financing arrangements, including bond issuance, to fund a major building project.

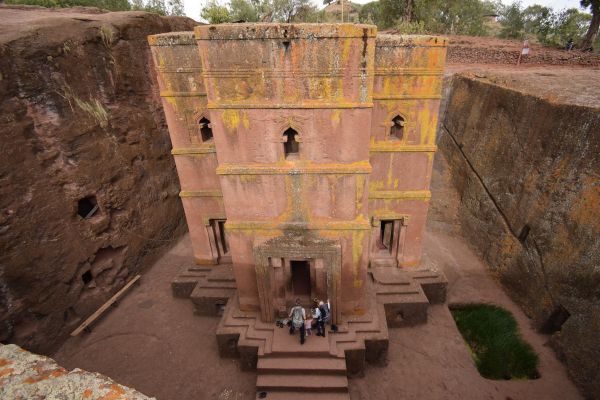

10.3 Historic Church Renovation

Discover how a historic church obtained specialized loans and grants to restore and modernize its centuries-old building while preserving its architectural integrity.

11. Conclusion

Securing a loan for a church building project is a complex but achievable goal. By thoroughly preparing your finances, understanding the loan process, and exploring all available options, your church can obtain the funding needed to create or improve its physical space. Remember that the journey doesn’t end with receiving the loan – responsible financial management and continued community engagement are crucial for long-term success.

As you embark on this significant undertaking, keep your mission and values at the forefront. A new or improved church building is not just a physical structure but a testament to your congregation’s faith, unity, and commitment to serving your community.

12. Frequently Asked Questions

- Q: How long does the church building loan process typically take? A: The process can take anywhere from 2 to 6 months, depending on the complexity of your project and the lender’s requirements.

- Q: What is the typical interest rate for a church building loan? A: Interest rates vary but generally range from 4% to 8%, depending on market conditions, your church’s financial health, and the loan terms.

- Q: Can a new church with a limited financial history qualify for a building loan? A: While it’s more challenging, new churches can qualify by demonstrating strong leadership, community support, and a solid business plan.

- Q: Are there government-backed loans available for church-building projects? A: Generally, government-backed loans are not available for religious organizations due to the separation of church and state. However, some community development programs may be accessible.

- Q: How much of a down payment is typically required for a church building loan? A: Down payments usually range from 20% to 30% of the total project cost, but this can vary depending on the lender and your church’s financial situation.

- Q: Can a church use a residential mortgage for a small building purchase? A: No, churches typically need to secure commercial or specialized religious building loans, as residential mortgages are not suitable for church properties.

- Q: What happens if a church defaults on its building loan? A: In case of default, the lender may foreclose on the property. It’s crucial to have a solid repayment plan and communicate with your lender if financial difficulties arise.

- Q: Are there lenders that specialize in church-building loans? A: Yes, several lenders focus specifically on church and religious organization financing. Research options like religious credit unions and specialized lending institutions.

- Q: How does a church’s tax-exempt status affect its ability to get a loan? A: While tax-exempt status doesn’t disqualify a church from getting a loan, it may impact the types of loans available and the documentation required.

- Q: Can a church refinance its building loan for better terms? A: Yes, churches can refinance their building loans, especially if their financial situation has improved or if market conditions offer more favorable terms.